Home Employee Time Tracking Piece Rate Pay

Piece Rate Pay: A Complete Guide

In this guide, learn everything there is to know about piece rate pay, including what it is, who it applies to, and how it’s calculated.

A compensation system that is frequently utilized yet little understood is piece rate pay. This system of remuneration, though not novel, is sometimes overlooked in favor of hourly or salaried structures. However, in certain industries and for specific roles, it has the unique potential to drive productivity and earnings.

Piece rate pay, at its most fundamental, is a payment system where employees are compensated based on the amount of output they produce rather than the hours they work.

From fruit pickers to freelance writers and from auto mechanics to assembly line workers, piece work pay is employed across a wide spectrum of industries, appealing to both employers and employees for its potential to align incentives with productivity.

In this comprehensive guide, we aim to offer a detailed exploration of piece rate pay, looking at its various facets — what exactly it is, who can benefit from it, how it’s calculated, and the pros and cons associated with it.

We will also explore best practices, legal considerations, and potential solutions to common issues related to piece rate pay. We intend to provide a resource that is equally useful to employers considering this system and employees who might find themselves working under it.

Whether you’re an employer considering new ways to incentivize and reward your workforce, an employee seeking to understand your pay structure better, or simply curious about the intricacies of this payment model, this guide aims to help you better understand piece rate pay and provide a well-rounded understanding of its complexities and potential.

What is Piece Rate Pay?

Piece rate pay is a compensation method where employees are paid a fixed sum for each unit of production completed rather than being paid for the hours they work. This pay structure is often seen in industries such as agriculture, manufacturing, or any other role where work output can be easily quantified.

The central premise of piece rate pay is that remuneration is directly linked to output. It differs significantly from the two other common forms of compensation: hourly wages and salaries.

As the name implies, hourly wages involve employees being paid a predetermined rate for each work hour. Regardless of the actual output, employees receive their wages based on time spent on tasks. This method is often used in jobs where the output cannot be easily measured or quantified, like customer service or office work.

On the other hand, a salary is a fixed annual amount that is usually divided into regular payments throughout the year, typically monthly or biweekly. Unlike piece rate or hourly pay, salaries are not directly linked to the number of hours worked or the quantity of output produced. Instead, salaried employees are paid for fulfilling their roles and responsibilities, regardless of the time it takes to accomplish them.

Piece rate pay is a unique compensation method directly rewarding productivity and efficiency. Linking payment to the number of units produced typically incentivizes employees to work more efficiently and produce more. This system can greatly benefit highly motivated and efficient workers who exceed standard output levels.

However, it’s also crucial to maintain quality while pursuing higher output. It’s worth noting that piece rate pay must still comply with minimum wage laws, meaning that workers’ earnings must equal the minimum wage for hours worked.

Who is Entitled to Piece Rate Pay?

The eligibility for piece rate pay is typically determined by the nature of the job and the overall industry. It’s most often seen in roles where the output can be clearly quantified, and the quality of work doesn’t vary significantly between units produced.

- Workers in agriculture, manufacturing, garment production, and furniture-making industries are often paid on a piece rate basis. For example, in the agriculture industry, workers may be paid per bushel of apples picked or per acre of field plowed. In the garment industry, workers might be paid per item of clothing sewn.

- Piece rate pay can also be used in the service industry. For instance, auto mechanics might be paid a set rate for each type of repair they complete, or data entry specialists may be compensated for each record they process.

- Freelancers and independent contractors in fields like writing, graphic design, and programming also often receive piece rate pay, earning a set amount per article written, per logo designed, or per line of code written.

However, not all workers are eligible for piece work pay. Jobs that require a high degree of creativity, problem-solving, or decision-making, such as executive roles, are typically not suitable for piece rate pay. Similarly, jobs without an easily quantifiable output, such as teaching or counseling, are typically compensated via salaries or hourly wages.

The primary reason companies in certain industries use piece rate pay is to incentivize efficiency and productivity. The more a worker produces, the more they earn, which can motivate workers to increase their output. It also allows employers to forecast labor costs based on production targets accurately.

However, it’s crucial to remember that despite the pay method, all workers are entitled to earn at least the minimum wage. If a worker’s piece rate earnings don’t equate to the minimum wage for the hours they’ve worked, the employer is typically required to make up the difference. Laws vary by location, so employers should always ensure they’re complying with local labor laws.

Piece Rate Pay Examples (& How To Calculate It)

Calculating piece rate pay is straightforward in theory: you simply multiply the number of units produced by the agreed-upon rate per unit. However, there can be complexities depending on local labor laws and the job’s specifics.

Example 1: Standard Piece Rate Calculation

Let’s take an example from the agricultural industry. Suppose a fruit picker is paid $2 per bushel of apples. If they pick 100 bushels in a day, their pay for the day would be calculated as follows:

Number of Units (bushels) x Rate per Unit (dollars per bushel) = Daily Pay

100 bushels x $2/bushel = $200

In this scenario, the fruit picker would earn $200 that day.

Example 2: Piece Rate with a Performance Bonus

Some employers also offer performance bonuses on top of the standard piece rate. For example, a furniture assembler might be paid $20 per piece, with a bonus of $100 if they assemble more than 50 pieces for that week. If the worker assembles 55 pieces in a week, their pay would be calculated as follows:

(Number of Units x Rate per Unit) + Bonus = Weekly Pay

(55 pieces x $20/piece) + $100 bonus = $1,200

In this scenario, the furniture assembler would earn $1,200 weekly, including the bonus.

Piece Rate Pay Calculation in California

California has specific laws regarding piece rate pay that require employers to pay for rest and recovery periods and “non-productive” time separately from the piece rate. This is in addition to ensuring the total wages earned meet the applicable minimum wage.

Let’s consider a garment worker in California who is paid $1 per garment sewn. They sew 500 garments in a 40-hour week and have 2 hours of rest and recovery time and 1 hour of non-productive time (time spent on tasks that don’t directly contribute to output, such as cleaning their workspace).

First, calculate the piece rate pay:

Number of Units x Rate per Unit = Piece Rate Pay

500 garments x $1/garment = $500

Next, calculate pay for rest and recovery time and non-productive time. In California, this must be paid at the average hourly rate (total piece work pay divided by total hours worked, excluding rest and recovery time) or the applicable minimum wage, whichever is higher.

Assuming the minimum wage in California is $15:

Rest and Recovery Time (hours) x Minimum Wage = Rest and Recovery Pay

2 hours x $15/hour = $30

Non-Productive Time (hours) x Minimum Wage = Non-Productive Pay

1 hour x $15/hour = $15

Finally, add the piece rate pay, rest and recovery pay, and non-productive pay together:

Piece Rate Pay + Rest and Recovery Pay + Non-Productive Pay = Total Pay

$500 + $30 + $15 = $545

Under California law, the garment worker would earn $545 that week. If the average hourly rate (piece rate pay divided by hours worked) turned out to be higher than the minimum wage, that rate would be used to calculate rest and recovery pay and non-productive pay instead.

Accurate time tracking is so much easier with Workyard

Try It For Free

Advantages of Piece Rate Pay

Piece rate pay offers several potential advantages for both employers and employees, provided it’s implemented thoughtfully and fairly.

For Employers

- Increased Productivity: By tying compensation directly to the output, piece rate pay can motivate workers to be more productive. Employees who know they’ll earn more if they produce more are often more motivated to increase their output and track their productivity.

- Cost Predictability: With piece rate pay, labor costs become more predictable. Employers can calculate the cost of labor per unit of output, which can aid in budgeting and cost management.

- Quality Assurance: In industries where the quality of each output unit can be easily assessed, piece rate pay can motivate workers to maintain high standards. If substandard work isn’t paid for, there’s a clear incentive to do the job right the first time.

- Efficiency: Piece rate pay can promote efficiency in work processes. Employees incentivized to increase their output may find and implement ways to do their jobs more efficiently.

For Employees

- Earning Potential: Piece rate pay can offer significant earning potential for efficient and hardworking employees. The more they produce, the more they earn, without a cap on potential earnings.

- Flexibility: In some roles, piece work pay can offer more flexibility. Employees may have the option to work at their own pace or choose their own hours, as long as they meet their output targets.

- Fairness: Some employees may perceive piece rate pay as fairer than hourly wages or salaries. They’re paid directly for their output, so two workers who produce different amounts will earn different wages.

- Motivation and Satisfaction: For some individuals, being paid for each unit of work can be more motivating and satisfying than being paid by the hour. They can see a direct correlation between their effort and their earnings, which can increase job satisfaction.

Of course, the effectiveness of piece rate pay can depend on many factors, including the nature of the work, the specific pay rates, and how well the system is managed. It’s also crucial that piece rate pay systems are designed to comply with all relevant labor laws, including minimum wage requirements.

Disadvantages of Piece Rate Pay

While piece rate pay has potential advantages, it also comes with potential pitfalls and drawbacks for both employers and employees.

For Employers

- Quality Control: While piece rate pay can incentivize greater productivity, it can also decrease overall quality if workers rush to produce more units. This is particularly true in industries where quality assessment is more subjective or complex.

- Employee Burnout: If workers feel pressured to constantly produce at high levels to earn a decent wage, it could lead to stress, decreased morale, and burnout over time. This could ultimately lead to higher turnover rates.

- Legal Compliance: Employers must ensure that workers’ earnings are at least equal to the minimum wage for the hours worked. If piece work pay doesn’t meet this standard, the employer may have to make up the difference, complicating payroll calculations.

For Employees

- Potential for Exploitation: There’s a risk that unscrupulous employers might set piece rates too low or demand unrealistic production quotas. This could result in employees being underpaid for their work, or even being paid less than the minimum wage.

- Income Instability: Because piece rate pay is tied to output, it can lead to income instability. If workers cannot produce as much due to illness, machinery breakdowns, supply chain issues, or other factors beyond their control, their income may suffer.

- Lack of Benefits and Protections: In some cases, workers paid by piece rate may not have access to the same benefits and protections as hourly or salaried workers. This can include paid time off, health insurance, and retirement benefits.

- Health and Safety Concerns: In their drive to produce more, workers may skip breaks, work too quickly, or ignore safety precautions, increasing the risk of accidents and injuries.

While piece rate pay can motivate workers to be more productive and offer potential cost benefits to employers, it’s critical to implement this system with care. Employers must set fair piece rates, establish realistic production quotas, and ensure compliance with all labor laws to protect their employees and business.

Best Practices for Implementing Piece Rate Pay

If you’re considering implementing piece rate pay in your business, these best practices can help ensure a fair and effective system:

Set Fair and Realistic Piece Rates

It’s crucial to set piece rates that are fair and realistic. They should reflect the time, effort, and skill required to produce each unit and allow workers to earn at least the minimum wage for their hours worked. It may be beneficial to seek employee input or conduct industry benchmarking to help determine appropriate rates.

Establish Clear Expectations and Guidelines

Clear communication is key when implementing piece rate pay. Workers need to understand how their pay is calculated, what is expected daily, and their defined quality standards. It’s also important to clearly define what constitutes “productive” and “non-productive” time, especially in jurisdictions like California, where these are paid at different rates.

Monitor Productivity and Quality

Regularly measure productivity and monitor quality to ensure the system works as intended. If productivity increases, but quality decreases, you may need to adjust your piece rates or implement additional quality control measures.

Ensure Legal Compliance

Ensure your piece rate pay system complies with all relevant labor laws. This includes paying at least the minimum wage, compensating for rest and recovery periods and non-productive time (where required), and providing all benefits and protections that workers are entitled to.

Provide Regular Feedback and Support

Regular feedback can help workers understand how well they’re doing and how they can improve. It can also give you insights into any issues or difficulties they face. Providing support, such as training or ergonomic assessments, can help workers increase productivity and prevent injuries.

Review and Adjust Regularly

Regularly review your piece rate pay system and make adjustments as needed. This could involve raising piece rates over time to account for inflation or increased living costs, adjusting rates if you find that certain tasks consistently take longer than expected, or implementing new productivity incentives. Regular system reviews help ensure your system remains fair, competitive, and effective.

Promote a Healthy Work Environment

While encouraging productivity, it also emphasizes the importance of rest, proper techniques, and workplace safety. Fostering a healthy work culture that values both productivity and employee well-being can help prevent burnout and reduce the risk of work-related injuries.

Legal Considerations for Piece Rate Pay

Employers must properly understand and adhere to various legal requirements when implementing a piece rate pay system. One of the central legal considerations involves minimum wage laws.

Irrespective of the payment method, all workers are entitled to earn at least the minimum wage. For piece rate workers, their total earnings from piecework must equal or exceed the minimum wage for their total hours worked. If their piecework earnings fall short, the employer must make up the difference.

In addition to minimum wage laws, overtime regulations are another key legal consideration. Under the Fair Labor Standards Act (FLSA) in the United States, non-exempt workers are entitled to overtime pay, typically calculated as one-and-a-half times their regular pay rate, for hours worked beyond 40 in a workweek.

The regular pay rate is calculated for piece rate workers by dividing the weekly earnings by the total hours worked. If a piece rate worker works more than 40 hours a week, they may be entitled to additional overtime pay.

In certain states like California, there are even more specific requirements. As mentioned, California law mandates employers to separately compensate piece rate workers for rest and recovery periods and “non-productive” time at specific rates.

Given the complexity of these laws and the potential penalties for non-compliance, employers should consult with a legal professional or a human resources expert when designing and implementing a piece work pay system. Employers should also stay updated on changes to labor laws in their jurisdiction, as these can impact legal obligations around piece rate pay.

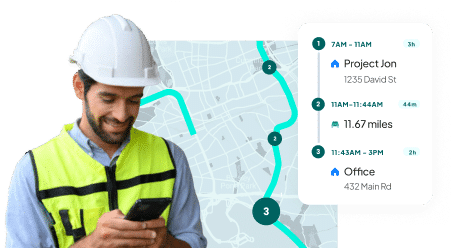

How to Accurately Compensate Workers with Workyard

Workyard is a powerful tool that makes managing and accurately compensating workers easier. By leveraging modern technology, Workyard streamlines several key processes associated with payments.

Firstly, Workyard automatically captures every worker’s start, break, and end times for each shift. This feature eliminates the need for manual time tracking and ensures that all work hours are accurately recorded. This saves administrative time and helps prevent disputes over hours worked.

Secondly, Workyard also automatically calculates the total hours worked by each employee, including any overtime. In doing so, Workyard helps streamline payroll processes and significantly reduce the chance of calculation mistakes, which can lead to both financial losses for the company and unfair compensation for workers.

Workyard’s GPS time clock app adds another layer of accuracy to the process. This app ensures every hour is accounted for, providing an objective record of when and where work was completed. This helps ensure that workers are compensated fairly and accurately for their time and provides employers with a reliable record of work hours.

Is Piece Rate Pay Right For Your Organization?

Piece rate pay can be a powerful tool for businesses, incentivizing productivity and potentially providing employees with a fair and rewarding pay structure. However, implementing it requires careful planning, clear communication, and diligent monitoring. Factors such as setting fair piece rates, ensuring quality work, and staying compliant with legal regulations are all vital considerations.

Workyard offers a comprehensive solution that can make managing people and payments easier. With features like automatic time tracking, overtime calculation, and a GPS time clock app, Workyard ensures every hour of work is accurately accounted for, making payroll simpler and more reliable.

Sign up for a free trial of Workyard today!